The Practical B.Com Program

Why should every student grab the opportunity with the Practical EduSkills B.Com Program?

Practical Eduskills B.Com Program is a course that bridges the gap between the Conventional Education System and the Industry Oriented Pragmatic knowledge required in the current corporate culture. There is a tough competition in the market and the one who strives, survives.

There is huge scope for the youth with the right knowledge and skill set that can carve out the professionals in them.

This concept is initiated with an objective to produce skilled professional graduates that meet the expectations of the corporates.

Features

Training on Laptop

Industry Oriented Experiential Syllabus

Knowledge from Industry Experts

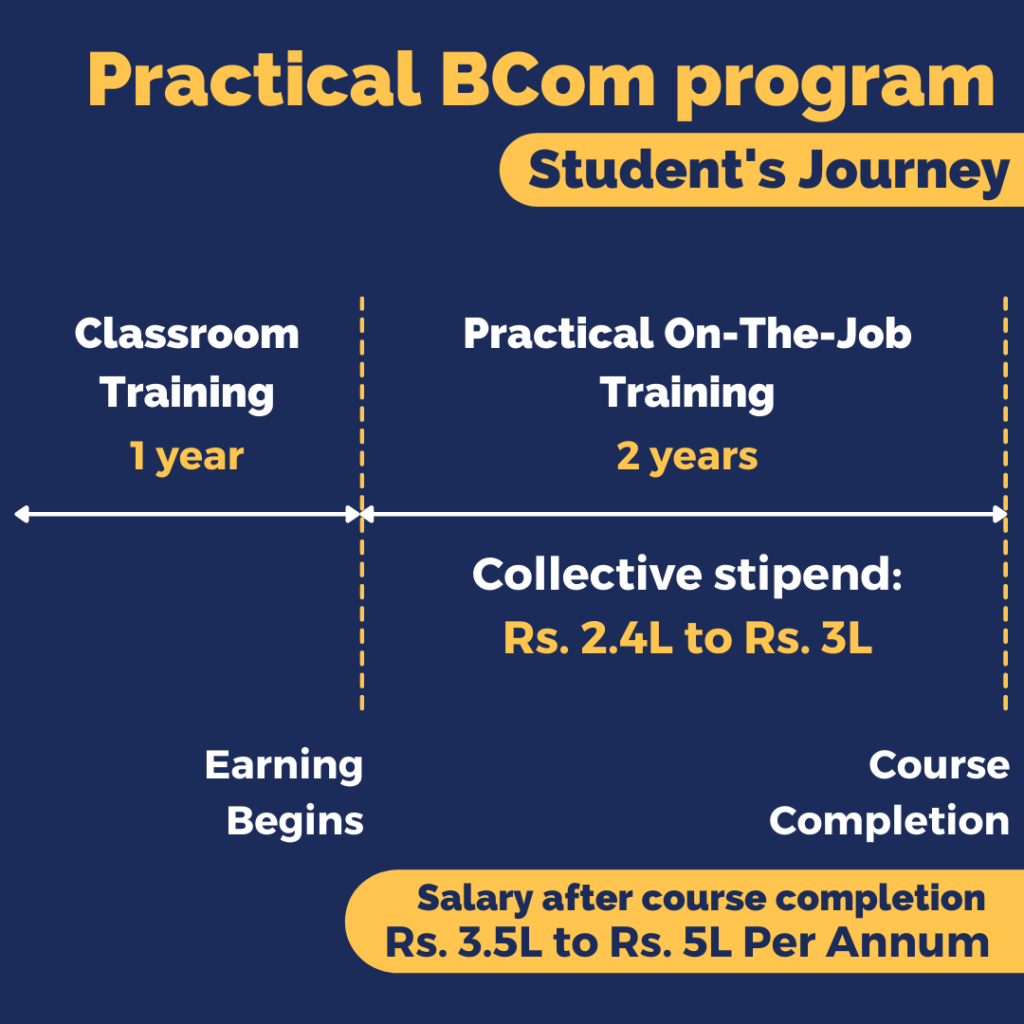

Earn and Learn TM - Collective stipend of ₹ 2.40L to ₹ 3.00L

Salary Slabs on Passing the course: ₹ 3.5 L to ₹ 5 L Per Annum

B.Com Degree from Recognised University

Laptop for every student

Industry Oriented Experiential Syllabus

Earn and Learn TM - Collective stipend of 2.40L to 3.00L

Salary Slabs on Passing the course: 3.5 L to 5 L Per Annum

Knowledge from Trained and Experienced Professionals

B.Com Degree from Recognised University

Course Structure

1st Year

Pragmatic Classroom Training in Accounts and Taxation

2nd & 3rd Year

Practical Learning as On The Job Training (Earn and Learn TM )

2nd Year

Practical Learning as On The Job Training (Earn and Learn TM )

3rd Year

Practical Learning as On The Job Training (Earn and Learn TM )

First Year

Business Accounting — Elementary

● Introduction

● Accounting Concepts

● Capital & Revenue Transactions

● Journal Entries

● Subsidiary Books

● Ledger

● Depreciation

● BRS

● Trial Balance

● Accounts Documents

Practical Computer Functioning

● Working with Latest Windows

● File & Folder Management

● Introduction to MS Word 2016

● Getting Functional with MS Word

● Introduction to MS Excel 2016

● Getting Functional with MS Excel

● MS PowerPoint 2016

● MS Outlook

● Internet & E-mailing

Language Proficiency — English

● Beginner - Parts of Speech

● Elementary - Basic English Grammar

● Advance - English Grammar

● Mastery - English Speaking & Writing Skills

Banking and Insurance

● Introduction to Banking System in India

● Structure of Banking System in India

● Types of Bank Accounts

● Negotiable Instruments

● Evolution of Internet Banking

● ATM & CDM

● KYC

● Learning Outcomes of Insurance

● Introduction of Insurance

● Concept of Insurance

● Introducing the Brief Idea of Insurance

Company Law

● Introduction to Law

● Indian Contract Act, 1872 - Important Terms

● Introduction to Company Law

● Incorporation of a Company

● Appointment of an Auditor

● Books of Accounts

● Annual Returns

● Board of Directors

● Meetings of the Company

● Winding up of the Company

Business Accounting — Intermediate

● Rectification of Errors

● Final Accounts for Various Business Organizations

● Single Entry System

● Accounts for Not for Profit Concerns

● Accounts Reconciliation

● Role of an Accountant

● Finalization of Accounts

Tally Prime

● Introduction and Getting Functional with Tally Prime

● Vouchers and Reports including Import & Export

● Bank Reconciliation Statement

● Cost Centre

● Inventory and Delivery Note

● Interest Calculations

● Features, Configurations and Security Control

● Taxation in Tally - Goods & Services Tax (GST) and TDS

● Payroll System

● Cloud Accounting

Direct Tax

● Introduction to Income Tax

● Residential Status

● Heads of Income

● Clubbing & Set-off and Carry Forward of Losses

● Deductions under Chapter VI-A

● PAN & TAN

● TDS & Tax Payments

● Filing of Income Tax Return

Goods & Services Tax

● Introduction to GST

● Supply under GST

● Registration

● Time, Place & Value of Supply

● Input Tax Credit (ITC)

● Returns

● E-way Bill

Professionalism

● Professionalism

● Professionalism at Workplace

● Ethics

● Interview Skills

● Office Administration

Second Year

QuickBooks

● Introduction

● Get Started with QuickBooks● Company File Setup

● Accounting in QuickBooks

● Budgets in QuickBooks

● Other Utilities in QuickBooks

Costing

● Basic Concepts of Costing

● Material, Labor and Overheads

● Budgetary Control

● Marginal Costing

Share Market

● Introduction to Stock Market

● Stock Exchanges

● Trading Items

● Trading in Stock Market

● Share Market Players

● Depository and Depository Participants

● Bullish and Bearish Market

● Investment

● Investment Assets

Third Year

Zoho

● Introduction

● Get Started with Zoho

● Company File Setup

● Accounting in Zoho

● Other Utilities in Zoho

Advance Excel

● Getting Functional to MS Excel

● Advance Excel Utilities and Practice

Important Info

10+2 passed with minimum 50% (Any stream, any Board)

Total Investment: Rs. 1,38,300/-

EMI starts from: Rs. 5,900/- (Registration Fees)

Stipend: Rs. 2.40L to 3.00L

FAQ's

Is Practical Eduskills B.Com Program a recognized university degree?

The Practical Eduskills B.Com Program is a Government recognized, UGC / AICTE approved course and is accepted by a long list of companies that we are associated with, as a credible and high-value adding practical education program.

Practical B.Com is a well designed educational concept that gives Practical Accounting knowledge along with traditional B.Com degree from a well known traditional University.

Practical B.Com = Practical Accounting Training + B.Com Degree (Traditional University)

What is the difference between Traditional B.Com and Practical B.Com?

Traditional B.Com emphasises education through textbooks and syllabus learning alone, while Practical B.Com couples traditional understanding with practical work experience and computer training for the application of learned modules. In a nutshell, Practical B.Com programs propels and advances a student, at least a year ahead in their career path, as compared to their counterparts pursuing traditional B.Com because of the hands-on experience that they already have by the time they pass the course.

Which stream is this program best suited for?

The curriculum is developed so that it makes it possible and easy for students from any graduation background to pursue. We also have in-house career guidance experts who can advise

What is the future scope of study for Practical B.Com?

Pursuing any higher specialized education within the country and off-shore is possible by all means. We also provide off-shore placement assistance. The work experience enables students to be independent in earning while pursuing further education.

Can students apply for jobs offshore after this course?

Since the degree is a government recognized graduate certification, students can apply for jobs offshore based on their knowledge and expertise along with their language skills

What will be the stipend received by students in the second and third year?

The stipend can range anywhere between Rs. 10,000 - Rs. 12,000 per month during their On The Job Training of 2 Years, depending on the interview performance.

Our Campuses

Pune - Swarate: Late Ramesh Damle College of Commerce

43, Shankar Rao Lohane Marg, T.M.V. Colony, Gultekadi, Pune, Maharashtra 411037

Contact Number: 9049793232

Pune - Pimpri Chinchwad: Pratibha College of Commerce and Computer Studies

Block D-III, Plot No. 3, Old Mumbai - Pune Hwy, Behind Mehta Hospital, Pimpri-Chinchwad, Maharashtra 411019

Contact Number: 9637223232

Baramati: College of Practical Commerce

College of Practical Commerce, Pencil Square, 4th Floor, Pencil Chowk, Vidyanagari, Baramati

Contact Number: 9130970057

Solapur: NK Orchid College of Engineering

Juni Mill Compound, Murarji Peth, In front of Aherkar Bajaj, Solapur

Contact Number: 8956467906

Our Association

Register Now !